We’ve built and grown our business based on three core pillars and believe we can help you do the same. These pillars are: Expertise, Transparency, and Accessibility.

Expertise: Technology and tax services expertise have enabled us to build a cloud-based, multi-tenant platform that allows you to work with and service your client from anywhere.

Transparency: As an Electronic Return Originator (ERO), you have 100% access to your own virtual tax business, with the ability to customize your virtual tax business using all TaxTC’s products and services made available to all tenants.

Accessibility: You are able to get a status update on clients’ tax returns and manage your virtual tax business in real-time, from anywhere.

We Are Different.

We differentiate ourselves from others by creating innovative tax preparation software that creates value for our customers. We provide services at the highest end of the value chain; we aren’t just an IRS e-file software developer and transmitter for the Modernized e-File (MeF) platform. We conceptualize e-file tax products, build them and sell them.

Technology

TaxTC ERO Cloud is web-based, multi-tenant tax preparation software and can be accessed from any computer with an internet connection. No special software is required. All tax computation is real-time. There is no need to wait until tomorrow to get the status of a return filing. TaxTC ERO Cloud provides role-based security and authority levels to ensure all information is safe and secure. In addition, our engineers utilize proven state-of-the-art security technologies and techniques in order to protect all systems, data, and information from unauthorized access.

Security

TaxTC ERO Cloud utilizes the preexisting Amazon AWS Cloud infrastructure and therefore shares several AWS standards and accreditations. All virtualized servers are run in the US East (Northern Virginia) region. Among others, Amazon AWS is certified by the following security compliance standards:

ISO 27001, 27017, 27018

FISMA

FIPS 140-2

PCI-DSS Level 1

EU Data Protection Directive (95/46/EG)

** Reference: Amazon Security Bulletins

TaxTC ERO Membership Club

Our ERO Membership Club plans give you everything you need to build your own successful tax preparation business, including a virtual tax office website. We offer you a range of products and a variety of payment options for your clients, ranging from bank refund products, debit cards, credit cards and e-checks to digital payments like PayPal and Authorize.net.

Integration

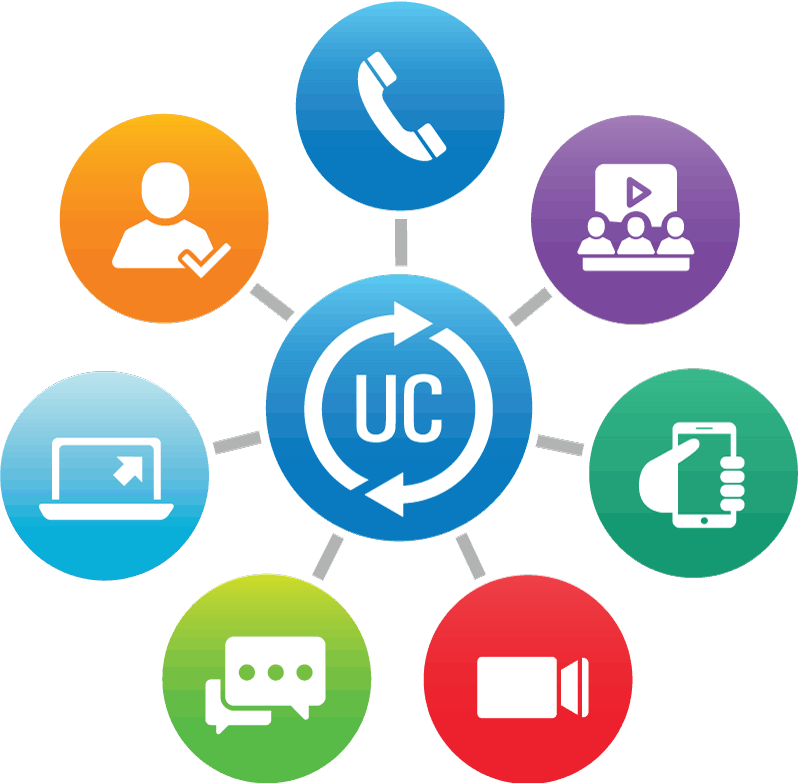

Entering the same information into multiple tax forms is not only inefficient but increases the opportunity for errors. TaxTC ERO Cloud uses machine learning to instantly “read” virtually any type of tax form and accurately extract text and data without the need for any manual effort or custom code. In addition, TaxTC ERO Cloud integrates with DocuSign for e-signature, RingCentral for communication, and various bank products for payment.

Schedule Your Free, No Obligation Consultation

To schedule your free consultation, fill out this form and a TaxTC’s business consultant will contact you shortly.

TaxTC ERO Support

TaxTC uOne is changing the game for EROs through workflow automation, enhanced client experience, and integrated capabilities to give EROs a complete virtual tax preparation software solutions.